Federal funds are

A. reserves that are loaned out on a very short-term basis by one bank to another bank.

B. loans banks make to their most credit-worthy customers.

C. required bank reserve.

D. funds owned by the Federal Reserve system.

A. reserves that are loaned out on a very short-term basis by one bank to another bank.

You might also like to view...

Under a fixed exchange rate regime, if a central bank must intervene to purchase the domestic currency by selling foreign assets, then, like an open market sale, this action ________ the monetary base and the money supply, causing the interest rate

on domestic assets to ________. A) increases; rise B) increases; fall C) reduces; rise D) reduces; fall

What is meant by full employment? Why isn't the full employment rate zero? What causes frictional unemployment?

What will be an ideal response?

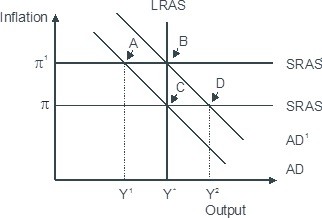

Based on the figure below. Starting from long-run equilibrium at point C, an increase in government spending that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ creating _____gap.

A. D; an expansionary B. B; no output C. B; expansionary D. A; a recessionary

Why do credit card companies typically require small minimum payment amounts on their customers' monthly credit card statements?

A. Credit card companies are concerned that their customers will be put in financial distress if required to make higher payments. B. Credit card companies want to promote faster repayment, and customers will be encouraged to pay more each month if they're able to pay well beyond the minimum. C. Credit card companies want to increase profits by promoting slower repayment, and actual customer payments will be anchored by the smaller payment requirements. D. Credit card companies actually charge the highest minimum payment they are allowed by law to charge.