Suppose ordinarily half your class would get an A and half would get a B, with A students having a 25% chance of getting an A and B students having a 25% of getting an A. It costs $100 to persuade the instructor to raise a B grade to an A. A student is willing to pay $40 to insure she will get her usual grade and $70 to insure she will get a higher grade than usual.

a. Who would buy insurance and at what price in a competitive equilibrium?

b. Suppose it costs $5 to truthfully signal your type and $10 to falsely signal what type of student you are, and if an insurance company receives no signal, it will interpret this as a signal that you are a B student. What would be the competitive outcome now?

c. Suppose a new teacher comes in -- and this teacher is willing to change a grade for just $60. How does your answer to (a) change?

d. How would your answer to (b) change?

e. Can you change something in the problem that would result in only A-students buying insurance?

What will be an ideal response?

a. The zero profit price if all students buy insurance would be $50 -- which A students aren't willing to pay. The zero profit price if only B students buy is $75 -- which B students won't pay. So no one is insured in the competitive equilibrium.

b. B students would be willing to falsely signal that they are A students in order to buy insurance at the zero profit price where everyone buys ($40) -- but A students aren't willing to buy at that price. And if only B students end up buying the insurance, the zero profit price has to rise to $75 -- in which case B students are not willing to signal. So no insurance is sold.

c. The zero profit price when everyone buys insurance is now $30 -- which both A and B-students are willing to pay. Thus, everyone buys insurance at a price of $30.

d. So long as everyone buys the insurance, the price will remain at $30. Now, however, it costs A students $35 to get that insurance (because of the $5 signaling fee) -- but that still results in surplus of $5 for A students. B students would effectively now pay $40 for A-insurance -- and they are willing to pay as much as $70. Thus, the equilibrium remains that everyone buys insurance at the price of $30.

e. There are a number of variables that could be changed: We could reduce the willingness of B students to pay for a higher grade; or we could increase the signaling cost for revealing false information.

You might also like to view...

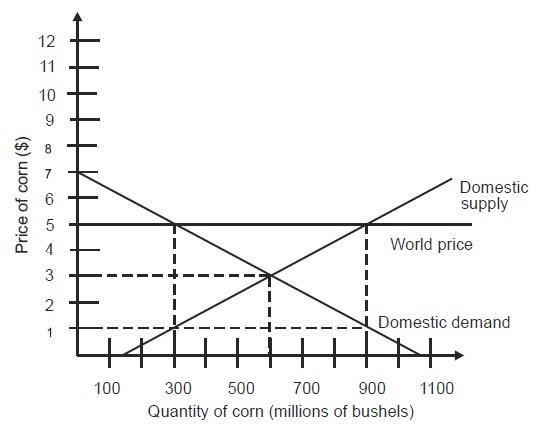

Explain the effects of a tariff on domestic production, the quantity bought, and the price

What will be an ideal response?

Which of the following statements about the Keynesian model is correct?

a. The economy would achieve full employment if left free from destabilizing government policies. b. Active monetary is always effective while fiscal policies is rarely so. c. Both Keynesians and classicists reach the same policy conclusions, but for different reasons. d. The economy is inherently unstable because of the instability of aggregate demand, which is primarily due to unstable expectations. e. both b and d.

In an open economy, the quantity demanded of corn in the domestic market is ________.

A. 150 million bushels B. 900 million bushels C. 300 million bushels D. 600 million bushels

Economic profits are maximized at the point at which

A. accounting profits are equal to zero. B. marginal revenues equal marginal costs. C. accounting profit exceeds economic profit. D. total revenues are greater than total costs.