The personal income tax varies as GDP changes.

Answer the following statement true (T) or false (F)

True

You might also like to view...

Inequality in the distribution of income in the United States today arises primarily from

A) the collapse of the government's income support system. B) the highly unequal distribution of corporate wealth. C) the tax system. D) the weakness of labor unions. E) unequal abilities to supply valuable human services.

Some luxury product manufacturers will purposefully raise prices on their goods in order to reduce sales volume. This strategy may successfully increase sales revenue if the luxury goods are subject to the ________ effect and have relatively ________ demand.

A. bandwagon; elastic B. snob; inelastic C. bandwagon; inelastic D. snob; elastic

"U.S. exports will increase as a result of joined CAFTA," is an example of a ________ statement, while "The U.S. should join CAFTA," is an example of a ________ statement.

A. normative; positive B. monetary policy; fiscal policy C. positive; normative D. structural policy; fiscal policy

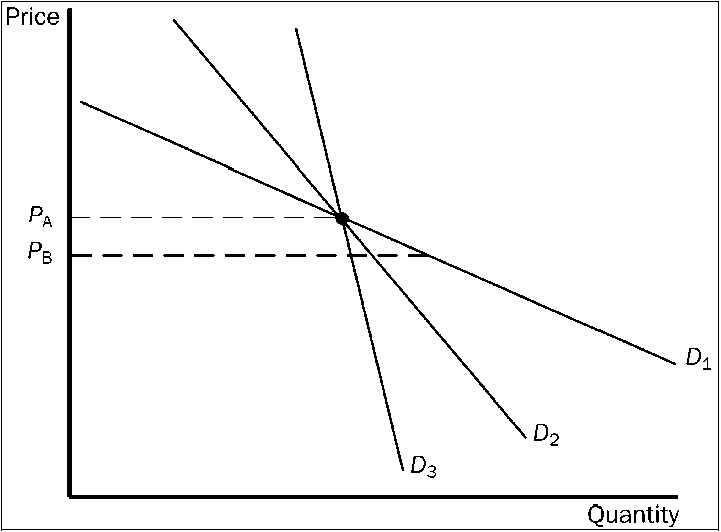

Figure 7-11

Refer to . As price falls from PA to PB, we could use the three demand curves to calculate three different values of the price elasticity of demand. Which of the three demand curves would produce the smallest elasticity?

a.

D1

b.

D2

c.

D3

d.

All of the above are equally elastic.