Formulate and solve this problem as a binary programming problem.

Kloos Industries has projected the availability of capital over each of the next three years to be $850,000, $1,000,000, and $1,200,000, respectively. It is considering four options for the disposition of the capital:

a. Research and development of a promising new product

b. Plant expansion

c. Modernization of its current facilities

d. Investment in a valuable piece of nearby real estate

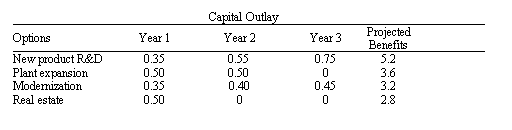

Monies not invested in these projects in a given year will NOT be available for the following year's investment in the projects. The expected benefits three years hence from each of the four projects and the yearly capital outlays of the four options are summarized in the table below in millions of dollars.

In addition, Kloos has decided to undertake exactly two of the projects. If plant expansion is selected, it will also modernize its current facilities.

Max 5.2X1 + 3.6X2 + 3.2X3 + 2.8X4

s.t. 0.35X1 + 0.50X2 + 0.35X3 + 0.50X4 ? 0.85 (Year 1)

0.55X1 + 0.50X2 + 0.40X3 ? 1.00 ( Year 2)

0.75X 1 + 0.45X3 ? 1.20 (Year 3)

X1 + X2 + X3 + X4 = 2

X2 + X3 ? 0

Xi = 0 or 1

X1 = 1, X2 = 0, X3 = 1, X4 = 0, total projected benefits = $8.4 million

You might also like to view...

In the post-September 11 business environment in the United States, imports have come under increased security. One of the initiatives taken in the interest of national security is:

A) NAFTA. B) C-TPAT. C) WTO. D) NTB. E) FSC.

According to the text, Zara's strategy of speed and flexibility has enabled the company to eliminate inventory.

Answer the following statement true (T) or false (F)

Walmart is known as a leader in supply chain collaboration efforts that are typically referred to as ____________.

What will be an ideal response?

Last year Emery Industries had $450 million of sales and $225 million of fixed assets, so its Fixed Assets/Sales ratio was 50%. However, its fixed assets were used at only 65% of capacity. If the company had been able to sell off enough of its fixed assets at book value so that it was operating at full capacity, with sales held constant at $450 million, how much cash (in millions) would it have generated?

A. $66.94 B. $78.75 C. $63.00 D. $74.81 E. $75.60