Two families who live in Plains, GA have identical incomes. The Smiths deduct $5,000 from their taxable income for mortgage interest paid during the year. The Jones family lives in an apartment and is not eligible for a mortgage-interest deduction. This situation exemplifies

a. an application of the benefits principle of taxation.

b. a violation of horizontal equity.

c. a violation of vertical equity.

d. an application of egalitarian tax rules.

b

You might also like to view...

An employee in a department store often steals goods when other employees are not around. Because the store does not have a surveillance camera, the store manager is unable to monitor his activities. This behavior is an example of ________

A) adverse selection B) moral hazard C) internalization of externalities D) the paradox of thrift

According to Tobin's q theory, when equity prices are low the market price of existing capital is ________ relative to new capital, so expenditure on fixed investment is ________

A) cheap; low B) dear; low C) cheap; high D) dear; high

An increase in the number of students attending college would tend to

a. reduce the demand for college professors. b. decrease the number of college professors employed. c. increase the demand for college professors. d. reduce the wage for college professors.

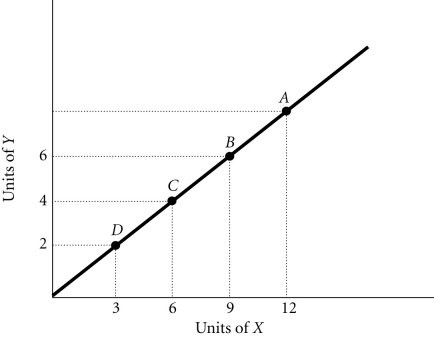

Refer to the information provided in Figure 1.7 below to answer the question(s) that follow. Figure 1.7Refer to Figure 1.7. The slope of the line between Points D and B is

Figure 1.7Refer to Figure 1.7. The slope of the line between Points D and B is

A. 1.5. B. 0.67. C. -0.67. D. -1.5.