To understand what causes the business cycle, leading variables alone are of interest. Coincident and lagging variables merely display the consequences of changes in the economy. Respond

What will be an ideal response?

The comment confuses correlation with causation. A leading variable is not necessarily causing the economy's moving through the cycle. It might, instead, be a result of some underlying process; a result that happens to become evident relatively early. Coincident and lagging variables do not merely appear on the stage after the causation is "done." They may point to powerful processes that happen to become fully evident only after other variables have responded to their effects. The reason that short-run economic fluctuations recur — and so invite the name "cycle" — is that most economic variables are continually affected by and affecting other variables; today's "effect" is tomorrow's "cause."

You might also like to view...

Before discovering that the short-run Phillips curve does not show the true long-run situation, policy makers were successful in trying to bring the economy to the zero-inflation, zero-unemployment point on the short-run curve

a. True b. False Indicate whether the statement is true or false

If changes in monetary policy are going to help stabilize the economy, they must

a. be expansionary. b. be restrictive. c. reduce the real rate of interest. d. be properly timed. e. stimulate aggregate demand.

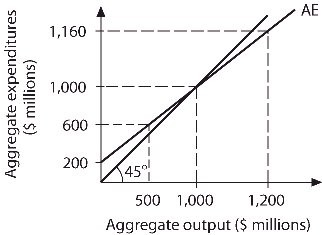

Refer to the information provided in Figure 23.10 below to answer the question(s) that follow. Figure 23.10Refer to Figure 23.10. Unplanned inventories decrease and output increases when aggregate output is

Figure 23.10Refer to Figure 23.10. Unplanned inventories decrease and output increases when aggregate output is

A. < $1,000 million. B. $1,000 million. C. $1,160 million. D. $1,200 million.

If the government spending multiplier is 10 and government purchases decrease by $20 billion, output will decrease by

A. $2 billion. B. $20 billion. C. $40 billion. D. $200 billion.