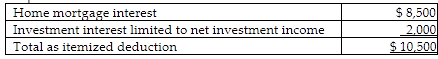

What is the amount of interest expense that can be deducted as an itemized deduction?

Teri pays the following interest expenses during the year:

A) $10,500

B) $10,900

C) $14,300

D) $14,700

A) $10,500

Personal interest is not deductible. Interest for the business is deducted as a for AGI deduction on Schedule C.

You might also like to view...

Gnome Company is deciding whether to continue to manufacture a component or to buy the component from a supplier. Which of the following is relevant to this decision?

A) the potential uses of the facilities that are currently used to manufacture the component B) the insurance on the manufacturing facility that will continue regardless of the decision C) fixed costs that do not differ between the alternatives D) the cost of the equipment that is currently being used to manufacture the component

Which of the following is (are) NOT correct regarding disclosure requirements lessees? I. For capital leases, future minimum lease payments in the aggregate and for each of the succeeding five years must be disclosed. II. For operating leases with initial or remaining lease terms in excess of one year, future minimum rental payments in the aggregate and for each of the five succeeding fiscal

years must be disclosed. III. For capital leases, future minimum lease payments for each of the succeeding five years must be disclosed. IV. For operating leases with initial or remaining lease terms in excess of one year, future minimum lease payments for each of the five succeeding fiscal years must be disclosed. a. I only b. II only c. Both I and II d. Both III and IV

Toyota employs all of the following principles and practices as part of The Toyota Way business philosophy EXCEPT:

A. respect people. B. continuously improve business processes and products. C. empower individuals and teams. D. build trust. E. provide personalized and customized products.

To use an organizational enhancement approach for the justification of new HRIS, one must use ______.

a. benchmarking on HR audit metrics b. the savings from self-service employee portals as the major savings c. the savings from decreasing the number of HR employees needed to process the HRM d. employee information e. a cost–benefit analysis