Assuming all excess reserves are loaned out, currency holdings by the public are zero, and a reserve ratio of 2 percent, an initial deposit of $500 will lead to a total increase in deposits of:

A. $250.

B. $5,000.

C. $25,000.

D. $50,000.

Answer: C

You might also like to view...

If a good has an external cost, then the marginal private cost curve

A) lies below the marginal social cost curve. B) lies above the marginal social cost curve. C) is negative. D) is the same as the marginal external cost curve.

How would the following factors affect equilibrium in the market for labor?

a. An increase in the demand for the product that a firm is producing b. The use of a new technology that halves the time that workers will take to produce a good c. An increase in the age when people begin to receive Social Security benefits.

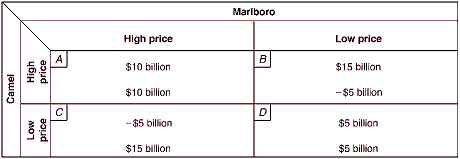

Exhibit 9-7 Two-Firm Payoff Matrix

?

A. Camel charging the high price and Marlboro charging the high price. B. Camel charging the low price and Marlboro charging the low price. C. Camel charging the low price and Marlboro charging the high price. D. Camel charging the high price and Marlboro charging the low price.

A constant-cost industry is one in which:

A. input prices do not change as output changes in the long run. B. supply is highly inelastic. C. the short-run supply curve is horizontal. D. All of these