What is a debt buyback? Why was a program of debt buybacks not sufficient to resolve the Debt Crisis?

What will be an ideal response?

A debt buyback is one example of the policies that many countries attempted to employ in an effort to reduce their debt burden. In a debt buyback, the country repays a loan at a discount. Such efforts did not suffice to resolve the Crisis for various reasons. First, programs such as debt buybacks require monetary resources, which were in limited supply. Second, such programs may not be very effective in reducing the outstanding debt. Several economists argue that when a country uses its own resources to buy back its troubled debt at a discount, the country's creditors are the only ones that benefit. Essentially, the debt buyback program drives up the secondary market price of the debt, reducing its effectiveness. For example, in the famous case of the 1988 Bolivia debt buyback, Bolivia used $34 million in donations to reduce the market value of its debt by only $8.8 million. It is ultimately more effective to deal with a solvency problem by taking a comprehensive approach that involves debt relief. That is essentially what the Brady plan set out to do.

You might also like to view...

Describe the different techniques that you can use to subordinate the refusal in a bad-news message

Phase III of the supply chain design and facility location process is to ______.

a. determine the configuration of regional facilities b. determine location choices c. design the supply chain d. select potential sites for locating facilities

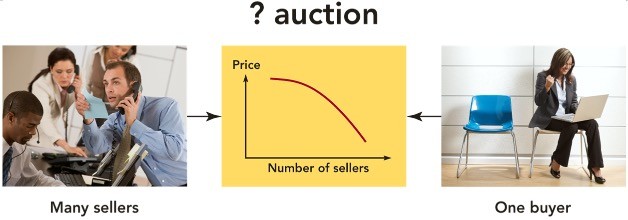

Figure 5-6BIn Figure 5-6B above, as the number of sellers increases, the price

Figure 5-6BIn Figure 5-6B above, as the number of sellers increases, the price

A. fluctuates depending on economic conditions. B. increases. C. decreases. D. stays the same. E. has no relation to the number of sellers.

As related to sensitivity analysis in linear programming, when the profit increases with a unit increase in labor, this change in profit is referred to as the:

a. add-in price b. sensitivity price c. shadow price d. additional profit