Solve the problem.

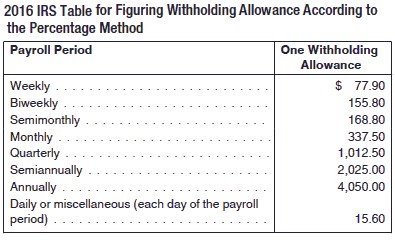

Larissa Dalton earns $7874.27 semimonthly, is married, and claims 3 withholding allowances. Find her net earnings for this pay period. Social security tax is 6.2% and Medicare tax is 1.45%.

Larissa Dalton earns $7874.27 semimonthly, is married, and claims 3 withholding allowances. Find her net earnings for this pay period. Social security tax is 6.2% and Medicare tax is 1.45%.

A. $7271.89

B. $6453.27

C. $8692.89

D. $5850.89

Answer: D

You might also like to view...

Solve the problem.The cost C of producing t units is given by C(t) = 3t2 + 8t, and the revenue R generated from selling t units is given by  For what values of t will there be a profit?

For what values of t will there be a profit?

A. There will be a profit when more than 9 units are sold. B. There will be a profit when more than 7 units are sold. C. There will be a profit when more than 8 units are sold D. There will be a profit when 0 units are sold.

Write the complex number in trigonometric form. Round the angle to the nearest hundredth of a degree.

?

A.

B. ?

C. ?

D. ?

E. ?

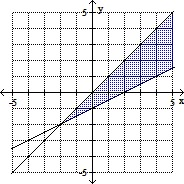

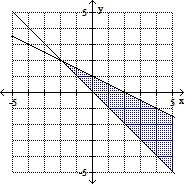

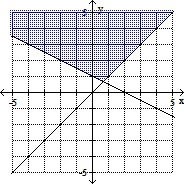

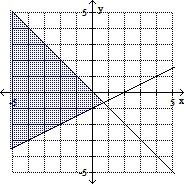

Graph the solution of the system.x - 2y ? 2 x + y ? 0

A.

B.

C.

D.

Find the partial derivative.Find fy(4, 1) when f(x, y) = 4xy - 3y.

A. 0 B. 13 C. 16 D. 4