The tax base is

A) the minimum amount of tax revenue that government must collect each year.

B) the maximum amount of tax revenue that government must collect each year.

C) the sum of all incomes earned in the United States.

D) the value of all goods, services, incomes, or wealth subject to taxation.

D

You might also like to view...

When the efficient quantity of output is produced

A) the marginal social benefit of the last unit produced is equal to the marginal social cost of the last unit produced. B) the sum of consumer surplus and producer surplus is maximized. C) resources are used in the activities in which they are most highly valued. D) All of the above answers are correct.

Pat earns $25,000 per year (after taxes), and Pat's spouse, Chris, earns $35,000 (after taxes). They have two pre-school-aged children. Childcare for their children costs $12,000 per year. Given that Chris doesn't want to stay home with the kids, regardless of what Pat does, Pat should stay home with the kids if, and only if, the value of Pat spending more time with the kids is greater than:

A. $13,000 per year. B. $37,000 per year. C. $25,000 per year. D. $12,000 per year.

The majority of evidence points to the fact that, in the last decade in the United States, labor productivity has

A) stayed the same. B) increased. C) decreased in the manufacturing sector but increased in the service sector. D) decreased.

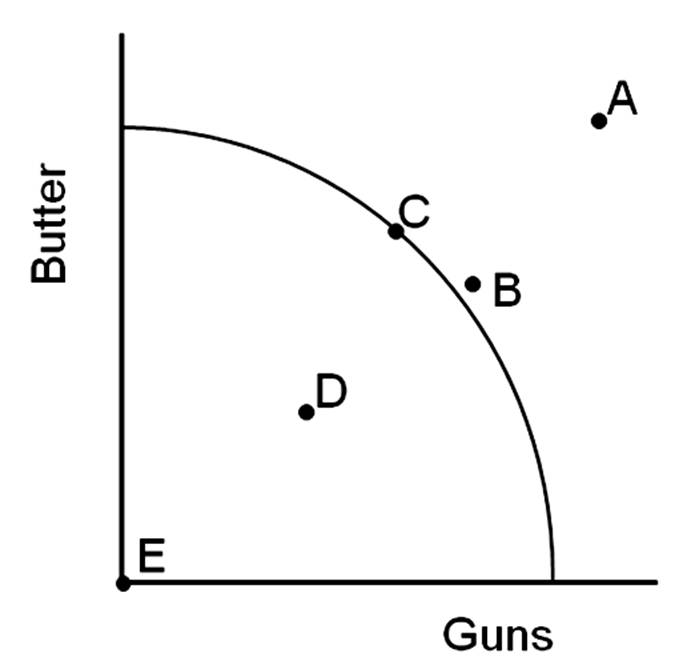

Which set of points would show a movement from depression to full employment?

A. a movement from Point C to B

B. a movement from Point B to A

C. a movement from Point C to E

D. a movement from Point D to C