When revenue is earned from charge account sales, the accountant:

A. debits Cash and credits a revenue account.

B. debits Accounts Receivable and credits a revenue account.

C. debits a revenue account and credits Accounts Receivable.

D. debits a revenue account and credits the capital account.

Answer: B

You might also like to view...

The ____________________ method results in the best approximation of replacement cost of goods sold on the income statement during periods of rising prices

Fill in the blank(s) with correct word

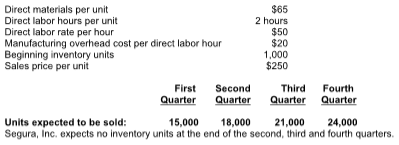

From the following details provided by Segura, Inc., prepare the cost of goods sold budget for the year.

Answer the following statements true (T) or false (F)

1. Maryland Services purchased 10 delivery vehicles by issuing a 10-year installment note payable for $320,000. This transaction is shown in the investing activities section of the statement of cash flows. 2. Selling property, plant, and equipment for $10,000 cash is considered a cash inflow from investing activities on the statement of cash flows. 3. When computing investing cash flows, it is helpful to evaluate the T-accounts for each long-term liability. 4. On the statement of cash flows, the investing activities section is shown after the financing activities section.

As a result to the research with the Connecticut Interracial Commission, ______ were born.

a. lab groups b. leadership groups c. sociotechnical groups d. T-groups