In the figure above, U.S. consumers' ________ from the tariff is ________

A) loss; $176 million

B) gain; $64 million

C) loss; $80 million

D) gain; $128 million

A

You might also like to view...

The cost of inflation will be minimized if:

A) the growth rate of inflation equals the rate of growth of wages. B) taxes are increased during the periods of high inflation. C) money supply is increased during times of high inflation. D) the growth rate of inflation exceeds the rate of growth of wages.

As the financial crisis became more severe in 2008, the Federal Reserve undertook a(n) ________ of monetary policy, an effect of which is to ________ inflation

A) contraction; raise B) easing; raise C) contraction; lower D) easing; lower E) none of the above

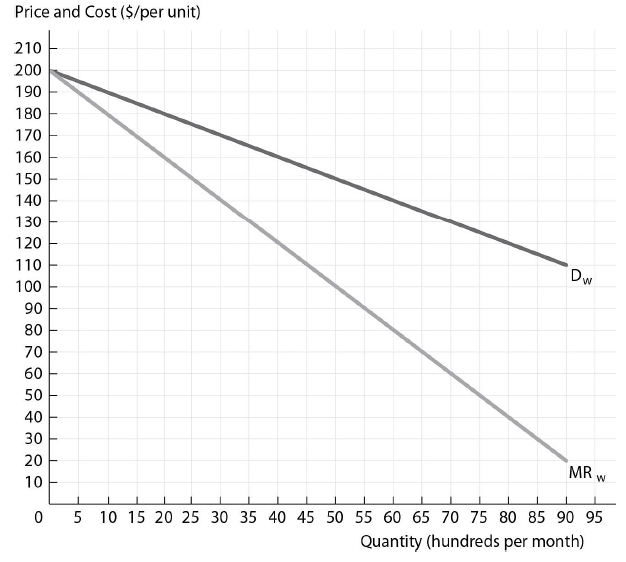

Slick Shades has a constant marginal cost of production equal to $40 and the distributors have a constant marginal cost of distribution equal to $20. If Slick Shades is producing the profit-maximizing number of sunglasses (in hundreds) and charging the profit-maximizing wholesale price, what is the retail price?

The figure above shows the wholesale demand and marginal revenue curves for Slick Shades Sunglasses, a sunglasses firm with market power. Slick Shades Sunglasses has a constant marginal cost of production and it sells to perfectly competitive independent retail distributors that have a constant marginal cost of distribution.

A) $160

B) $140

C) $150

D) $120

In what type of analysis will an increase in the tax rate always lead to an increase in tax revenues?

A) ad valorem taxation B) excise taxation C) dynamic tax analysis D) static tax analysis