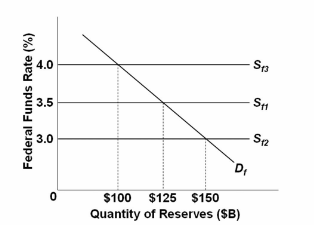

Refer to the diagram for the federal funds market. If the quantity of reserves rises from $100 billion to $150 billion, we can expect:

A. the federal funds rate to fall to 3.5 percent.

B. the discount rate to fall.

C. the prime interest rate to fall below 4.0 percent.

D. banks to become more cautious in lending.

B. the discount rate to fall.

Economics

You might also like to view...

What type of income tax is reflected in the table above?

A) regressive income tax B) proportional income tax C) progressive income tax D) negative income tax

Economics

If the nominal interest rate is 5 percent and the real interest rate is 7 percent, then the inflation rate is

a. -2 percent. b. 0.4 percent. c. 2 percent. d. 12 percent.

Economics

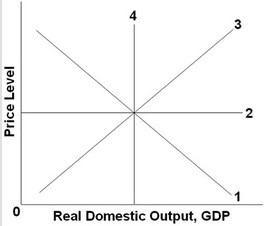

Refer to the above graph. The immediate-short-run aggregate supply curve would be represented by which line?

Refer to the above graph. The immediate-short-run aggregate supply curve would be represented by which line?

A. 1 B. 2 C. 3 D. 4

Economics

What is the highest price the monopolist could charge and still sell fish?

Economics