Which of the following is an argument that the incidence of corporate taxation falls entirely on consumers?

A. Most taxes on consumers are collected by corporations through sales taxes.

B. Corporations pass their tax burdens on to consumers because consumers ultimately work for the corporations.

C. Corporations always evade taxes so that consumers ultimately bear the tax burdens as taxpayers.

D. Corporations pass their tax burdens on to consumers by charging higher prices equal to the amount of the tax.

Answer: D

You might also like to view...

According to the traditional Keynesian analysis, if the government increases spending and pays for all of it by raising current taxes, then

A) a budget surplus will occur. B) aggregate demand will increase. C) a budget deficit will occur. D) aggregate demand will decrease.

The Fed can engage in preemptive strikes against a rise in inflation by ________ the federal funds interest rate; it can act preemptively against negative demand shocks by ________ the federal funds interest rate

A) raising; lowering B) raising; raising C) lowering; lowering D) lowering; raising

Part of the story of the interest rate effect is that a lower price level causes __________ in the demand for credit, which then causes the interest rate to __________

A) a decrease; fall B) a decrease; rise C) an increase; fall D) an increase; rise

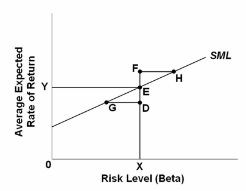

Refer to the graph. Consider an asset represented by point F. The process of arbitrage will draw investors to the higher rates of return,

A. increasing both price and the average expected rate of return.

B. changing the intercept of the Security Market Line until it intersects point F.

C. changing the slope of the Security Market Line until it intersects point F.

D. increasing the asset's price and lowering the average expected rate of return.