Find the Social Security tax (6.2%), Medicare tax (1.45%), and state disability insurance deduction (1%) for the employee. Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that  is paid for any overtime in a

is paid for any overtime in a  week. Round to the nearest cent if needed. Hours Reg FICA Medicare SDIEmployee Worked Rate Tax Tax TaxBush, H. 45 $7.90

week. Round to the nearest cent if needed. Hours Reg FICA Medicare SDIEmployee Worked Rate Tax Tax TaxBush, H. 45 $7.90

A. $33.06, $7.73, $5.33

B. $19.59, $4.58, $3.16

C. $23.27, $5.44, $3.75

D. $22.04, $5.15, $3.56

Answer: C

Mathematics

You might also like to view...

Determine if the series  defined by the formula converges or diverges.a1 = 6, an+1 =

defined by the formula converges or diverges.a1 = 6, an+1 =  an

an

A. Diverges B. Converges

Mathematics

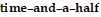

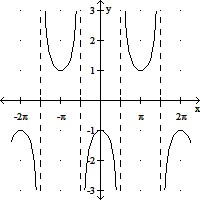

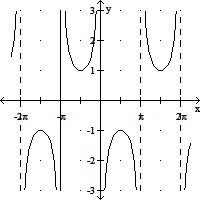

Match the function with its graph.1) y = sec x 2) y = csc x3) y = -sec x 4) y = -csc xA) B)

C)D)

C)D)

A. 1A, 2B, 3C, 4D B. 1A, 2D, 3C, 4B C. 1C, 2A, 3B, 4D D. 1B, 2D, 3C, 4A

Mathematics

Rationalize the numerator. Assume that all variables represent positive real numbers.

A.

B.

C.

D.

Mathematics

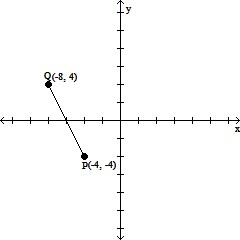

Find the distance between P and Q and the coordinates of the midpoint of the segment joining P and Q.

A. 4 ;

;

B. 4;

C. 4 ;

;

D. 4;

Mathematics