Ryan and Peter share profits in the ratio 3:2. They liquidate the partnership. The furniture and equipment sold at a loss of $50,000. The accounts receivable were collected in full and the other assets were written off as worthless. The cash balance remaining to pay the liabilities is ________.

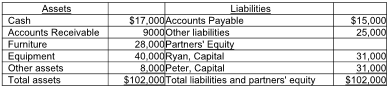

The balance sheet of Ryan and Peter's partnership as of December 31, 2018, is given below.

A) $17,000

B) $94,000

C) $44,000

D) $40,000

C) $44,000

Beginning cash balance $17,000

Sale of equipment and furniture ($68,000 - $50,000) 18,000

Accounts Receivable 9000

Ending cash balance $44,000

You might also like to view...

Choose the correct word or words in parentheses. Do you think (it's, its) possible to finish the project under budget?

Which of the following is true of effective delegation?

A. A manager can withhold resources for completion of the delegated task. B. The ideas of the subordinate should not be taken into consideration during delegation. C. Throughout the delegation process, the manager and the subordinate must work together. D. Once a task has been delegated, the manager need not be available. E. Tasks such as disciplining subordinates and conducting performance reviews are best delegated.

In a vertical analysis of the income statement, each line item is shown as a percentage of net sales

Indicate whether the statement is true or false

What is the payback period for a project with an initial investment of $180,000 that provides an

annual cash inflow of $40,000 for the first three years and $25,000 per year for years four and five, and $50,000 per year for years six through eight ? A) 5.80 years B) 5.59 years C) 5.20 years D) 5.40 years