The imposition of a sales tax on jewelry would result in

A. an increase in demand for jewelry.

B. an increase in the quantity demanded for jewelry.

C. a reduction in the demand for jewelry.

D. a reduction in the quantity of jewelry demanded.

D. a reduction in the quantity of jewelry demanded.

You might also like to view...

The main avenue by which a temporary change in government purchases in the classical model affects the labor supply is by

A) changing the population. B) affecting the value of the stock market. C) increasing business confidence. D) affecting workers' wealth.

The aggregate demand curve

a. represents the relationship between prices and quantities of all goods produced in an economy b. is derived from equilibrium conditions in the labor and money markets c. gives the equilibrium level of real GDP corresponding to a given price level d. is the sum of an economy's individual demand curves e. plots the interest rate as a function of output

If a U.S. dollar currently purchases 1.3 Canadian dollars and the inflation rate in Canada over the next year is 5 percent while it is 2 percent in the U.S., we should expect a U.S. dollar to purchase:

A. 1.365 Canadian dollars. B. 1.300 Canadian dollars. C. 1.339 Canadian dollars. D. 1.262 Canadian dollars.

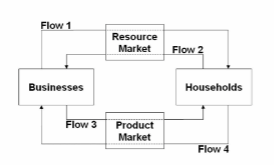

Refer to the diagram. Flow 1 represents:

A. wage, rent, interest, and profit income.

B. land, labor, capital, and entrepreneurial ability.

C. goods and services.

D. consumer expenditures.