What was the main reason the Fed stopped announcing growth targets for money aggregates in the early 2000s?

What will be an ideal response?

The main reason is that the link between the monetary base and the supply of M2 and M3 seemed to breakdown in the sense that it was constant or predictable. This meant that the money multiplier is unstable or unpredictable. Control of the monetary base does not give central bankers control over the money aggregates over a two- or three-year period which is usually the horizon used for short-term policy making.

You might also like to view...

On ________, October 19, 1987, the stock market experienced its worst one-day drop in its entire history with the DJIA falling by 22%

A) "Terrible Tuesday" B) "Woeful Wednesday" C) "Freaky Friday" D) "Black Monday"

Everything else held constant, when output is ________ the natural rate level, wages will begin to ________, increasing short-run aggregate supply

A) above; fall B) above; rise C) below; fall D) below; rise

Debt instruments are also called

A) equities. B) credit market instruments. C) prospectuses. D) units of account.

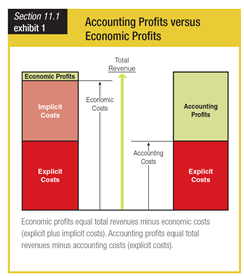

If the implicit costs shown for the firm in the Accounting Profits versus Economic Profits table doubled, the firm’s accounting profits would ______.

a. not be affected

b. decline by an amount equal to the change

c. increase by an amount equal to the change

d. decline to match the firm’s economic profits.