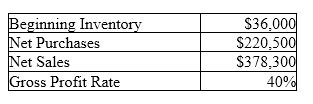

The Cyprus Company recently lost its entire inventory in a fire. The accounting records reflect the following information:

Using the gross profit method, estimated inventory is:

A) $102,600

B) $29,520

C) $36,000

D) Cannot be determined with given information.

B) $29,520

Explanation: beginning inventory + net purchases = cost of goods available for sale; net sales × gross profit rate = estimated gross profit, subtract this from net sales for estimated cogs; cost of goods available for sale - estimated cogs = estimated ending inventory. Ex: $36,000 + $220,500 = $256,500 cost of goods available for sale; $378,300 × 40% = $151,320, $378,300 - $151,320 = $226,980; $256,500 - $226,980 = $29,520

You might also like to view...

________ is some list of all the members of the population

A) Sample estimate B) Sample directory C) Sample frame D) Population directory E) all of the above

Which of the following correctly describes the accounting for administrative expenses of a manufacturing company?

A) Administrative expenses are product costs and are expensed as incurred. B) Administrative expenses are period costs and are expensed as incurred. C) Administrative expenses are product costs and are expensed when the manufactured product is sold. D) Administrative expenses are period costs and are expensed when the manufactured product is sold.

Dividends received on investments are accounted for in the same way under the cost-adjusted-to-market and the equity methods

Indicate whether the statement is true or false

A company will choose a cost-based pricing method based on the degree of trust it has in the cost base

Indicate whether the statement is true or false