Policymakers who wish to discourage businesses that pollute by taxing them:

A. should place a tax on consumers instead of the producers in order to increase the burden on sellers.

B. should place a tax on producers instead of the consumers in order to increase the burden on sellers.

C. forget that some of the tax burden will be shared by consumers.

D. forget that businesses will pass the entire tax onto consumers of their products.

Answer: C

You might also like to view...

The belief that the regulators of the U.S. financial system would not tolerate any losses by depositors at large depository institutions is called

A) the too-big-to-fail doctrine. B) the regulatory capture hypothesis. C) the lender of last-resort doctrine. D) corporate banking system welfare.

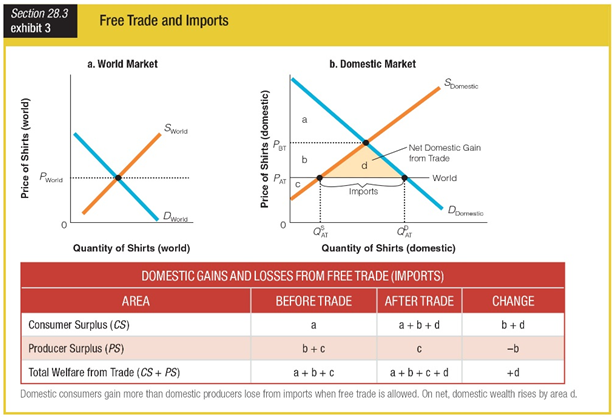

In Exhibit 3, what area(s) represent consumer surplus gains from imports after free trade is allowed?

a. a

b. b

c. a and b

d. b and d

Refer to Scenario 9.4 below to answer the question(s) that follow. SCENARIO 9.4: Sponsors invest $100,000 in a new deli on the promise that they will earn a return of 10% per year on their investment. The deli sells 52,000 sandwiches per year. The deli's fixed costs include the return to investors and $42,000 in other fixed costs. Variable costs consist of wages ($1,000 per week) plus materials, electricity, etc. ($2,000 per week). The deli is open 52 weeks per year.Refer to Scenario 9.4. Suppose the average price per sandwich is $5.50. What is the annual profit of the deli?

A. -$22,000 B. $78,000 C. $130,000 D. $244,000

What tools or tests are used by police departments to select police officers? Do you believe they are reasonable? Can the system be improved?

What will be an ideal response?