Wayne Company issued bonds with a face value of $930,000, a 10% stated rate of interest, and a 10-year term. The bonds were issued on January 1, Year 1, and Wayne uses the straight-line method of amortization. Interest is paid annually on December 31.Assuming Wayne issued the bonds for 106, the carrying value of the bonds on the December 31, Year 1 balance sheet would be:

A. $980,220.

B. $991,380.

C. $935,580.

D. $985,800.

Answer: A

You might also like to view...

If $100,000 is invested on December 31, 2016 to earn compound interest semiannually, and if the future value on December 31, 2022, is $225,219 what is the semiannual interest rate on the investment?

A) 7% B) 6% C) 5% D) 8%

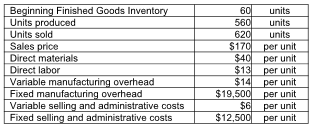

What is the unit product cost using absorption costing? (Round your answer to the nearest cent.)

Comet Canisters, Inc. has collected the following data for the current year:

A) $130.14

B) $67.00

C) $101.82

D) $61.82

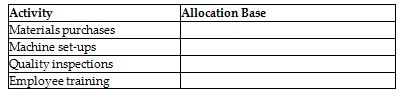

For each of the following activities, indicate an appropriate allocation base:

In periods of falling purchase prices and increasing inventory quantities, LIFO results in a _____ than either FIFO or the weighted-average cost-flow assumption

a. higher cost of goods sold; lower reported periodic income; lower current income taxes b. lower cost of goods sold; lower reported periodic income; lower current income taxes c. higher cost of goods sold; higher reported periodic income; lower current income taxes d. higher cost of goods sold; higher reported periodic income; higher current income taxes e. a lower cost of goods sold; higher reported periodic income; higher current income taxes