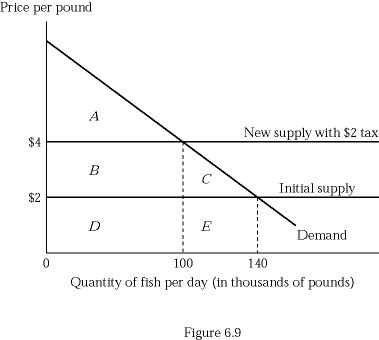

Figure 6.9 depicts a hypothetical fish market with a horizontal supply curve. Suppose the government imposes a tax of $2 per pound of fish, and the tax is paid in legal terms by producers. If the supply curve were positively sloped:

Figure 6.9 depicts a hypothetical fish market with a horizontal supply curve. Suppose the government imposes a tax of $2 per pound of fish, and the tax is paid in legal terms by producers. If the supply curve were positively sloped:

A. producers would bear the full cost of the tax.

B. consumers would bear the full cost of the tax.

C. both producers and consumers share the tax.

D. There is not sufficient information.

Answer: C

You might also like to view...

Property taxes are a major source of revenue for

A) state and local governments. B) the federal governments. C) the federal, state, and local governments. D) firms wanting to relocate their operations. E) consumers.

Figure 7-1

A. 1 B. 2 C. 3 D. 4

Mexico has a comparative advantage in producing corn:

A. regardless of the opportunity cost in other countries. B. if its opportunity cost of producing corn is higher than the opportunity cost in other countries. C. if its opportunity cost of producing corn is lower than the opportunity cost in other countries. D. if its opportunity cost of producing corn is the same as the opportunity cost in other countries.

What is the difference between inferior goods and normal goods

What will be an ideal response?