When investors follow a "herd instinct," they:

A. only makes decisions as a group, making it hard to determine individual behavior.

B. make decisions as a group, inflating the prices of goods somewhat arbitrarily.

C. invest in something simply because everyone else is doing it.

D. invest in something as a group, making it appear more valuable than it is.

Answer: C

You might also like to view...

If a single-price monopoly is making a large economic profit, what keeps other firms from competing away the profit?

A) There are barriers to entry. B) The monopoly must be keeping the amount earned secret. C) The market must be too small. D) The existing firm's ATC must be too large to allow competitors to enter and earn an economic profit. E) Nothing, other firms will enter and will compete away the profit.

Explain Tobin's idea of "Don't put all your eggs in one basket."

What will be an ideal response?

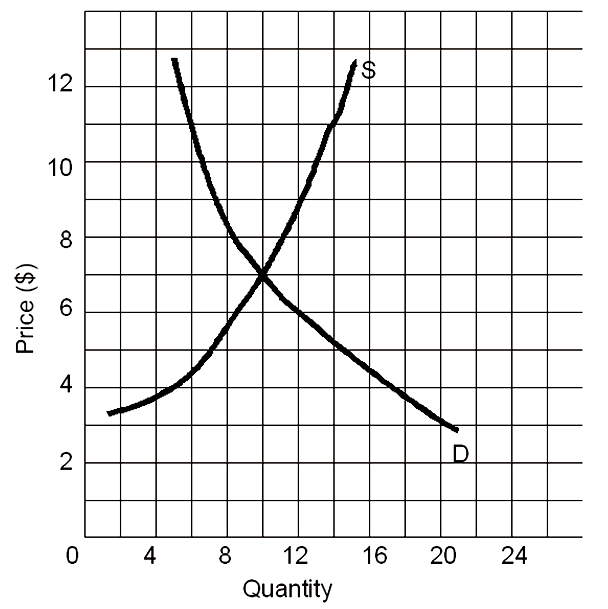

Equilibrium price is _____ and equilibrium quantity is _____ units.

A. $8; 9

B. $7; 10

C. $6; 10

D. $5; 9

One company has 90% of the market for cola soft drinks. An antitrust action against this company is likely to be defended (by the company) by the argument that

A. there is no substitute for cola soft drinks. B. the market share is not important. C. the relevant market is for cola soft drinks. D. the relevant market is not that for cola soft drinks but for all soft drinks.