Friedman's theory of money demand differs from Keynes' in that

a. Friedman assumes that the demand for money is highly elastic while Keynes assumes money demand is inelastic.

b. Friedman assumes that the money demand function is highly stable while Keynes assumes it is unstable.

c. Friedman assumes that there is only a speculative demand for money while Keynes also considers the precautionary and transactionary demands for money.

d. Friedman assumes that the proportion of income held in the form of money is constant while Keynes believes it varies.

e. both b and d.

E

You might also like to view...

Consumers value the product-specific services for a new smartphone at $25 and the marginal cost to the retailers for providing the product-specific services is $20. If the retailers provide the product-specific services, which of the following is true?

A) The shift in the market demand will equal the shift in the market supply. B) The shift in the market demand will exceed the shift in the market supply. C) The shift in the market supply will be exactly double the shift in the market demand. D) The shift in the market supply will exceed the shift in the market demand.

If U.S. buyers purchased $500 billion of foreign goods and foreign buyers purchased $400 billion of U.S. goods, the U.S. balance of trade would be:

a. ?$100 billion. b. $100 billion. c. $400 billion. d. none of these.

Typically, oligopolistic industries have a high ______.

a. number of sellers b. level of perfect competition c. number of monopolies d. rate of profit

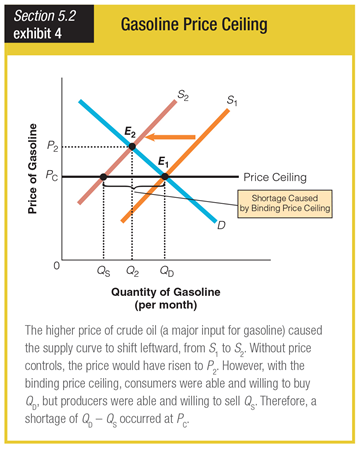

How would the graph change if the price ceiling was removed?

a. P2 would move to PC.

b. QD and QS would move to Q2.

c. PC would move to E1.

d. Q2 and QD would move to QS.