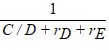

What would be the amount of deposits D, given that the monetary base MB = $750 billion, the required reserve rate (rD) = 0.1, the excess reserve rate (ER/D) = 0.005, and non-bank currency to deposits (C/D) equaled 1.2?

What will be an ideal response?

We can solve for D using the following equation: D =  xMB, substituting in the values given, we obtain $574.7 billion.

xMB, substituting in the values given, we obtain $574.7 billion.

You might also like to view...

Borrowed funds that are to be repaid in a year or more are referred to as:

A) long-term debt. B) loanable funds. C) annual debt. D) stockholders' equity.

How does the principal-agent problem extend to managers and employees?

What will be an ideal response?

Economists believe that individuals:

A. have varying tastes for taking on financial risks, but are risk-averse in general. B. have the same tastes for taking on financial risks, and are risk-averse in general. C. have varying tastes for taking on financial risks, but are risk-seekers in general. D. have the same tastes for taking on financial risks, and are risk-seekers in general.

If a country has a high level of growth in income, it:

A. must have a high level of income. B. must be rapidly increasing its GDP per capita. C. must have an equitable distribution of wealth. D. All of these are true.