Vertical equity in taxation refers to the idea that people

a. in unequal conditions should be treated differently.

b. in equal conditions should pay equal taxes.

c. should pay taxes based on the benefits they receive from the government.

d. should pay a proportional tax rather than a progressive tax.

a

You might also like to view...

Why are climate and environmental quality considered to be public goods? What are the implications?

What will be an ideal response?

If the law of one price holds for a single good, then absolute PPP measured with price indexes will also hold

Indicate whether the statement is true or false

Virtually all economists and policy makers agree that, within limits, higher employment is better. If this is true, couldn't the government create more employment by hiring people to dig holes and fill them in again? Is this good economic policy?

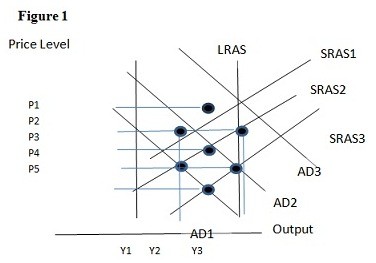

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.