A manager should attempt to maximize the value of the firm by changing the capital structure if and only if the value of the firm increases:

A) as a result of the change.

B) to the sole benefit of the managers.

C) to the sole benefit of the debtholders.

D) while also decreasing shareholder value.

E) while holding stockholder value constant.

A) as a result of the change.

You might also like to view...

Sebastian, an employee, understands that he has great potential after taking a self-assessment test at his company. He decides to create a checklist of short-term objectives to achieve to help him hone his skills. In this scenario, Sebastian is employing ________ as a mechanism of career management.

A. self-assessment B. goal setting C. assessment D. feedback E. appraisal

Prime Industries Inc. is a large company producing a wide range of chemicals. It decides to focus on making its products more environmentally friendly. This is an example of

A. conscious marketing. B. a supply chain. C. providing assortments. D. vertical integration. E. wholesaling.

What are some of the ethical responsibilities of researchers when they are developing scales?

What will be an ideal response?

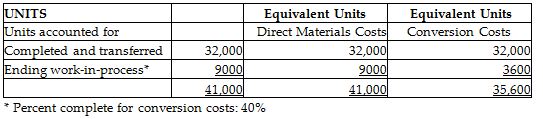

Eco-Eliminator Manufacturing produces a chemical pesticide and uses process costing. There are three processing departments—Mixing, Refining, and Packaging. On January 1, the first department—Mixing—had no beginning inventory. During January, 41,000 fl. oz. of chemicals were started in production. Of these, 32,000 fl. oz. were completed, and 9000 fl. oz. remained in process. In the Mixing Department, all direct materials are added at the beginning of the production process, and conversion costs are applied evenly throughout the process. The weighted-average method is used.

At the end of January, the equivalent unit data for the Mixing Department were as follows:

In addition to the above, the cost per equivalent unit were $1.80 for direct materials and $5.25 for conversion costs. Using this data, calculate the cost of the units that were transferred out of the Mixing Department and into the Refining Department.

A) $168,000

B) $110,400

C) $225,600

D) $57,600