Which of the following could explain why the government blocked the potential merger between Office Depot and Staples?

a. The merger would have increased the Herfindahl-Hirshman Index for that industry.

b. The merger would have increased the level of perfect competition in the industry.

c. The merger posed a threat to foreign competition in the industry.

d. The merger would have eased the barriers to entry in that industry.

a. The merger would have increased the Herfindahl-Hirshman Index for that industry.

You might also like to view...

If the marginal net utility of beer is a positive number, the consumer should buy more beer in order to maximize utility.

Answer the following statement true (T) or false (F)

When Pepsi is considering a price hike, it needs to consider how Coke may react. This situation is called:

a. mutual interdependence. b. price leadership. c. collusion. d. monopolistic competition.

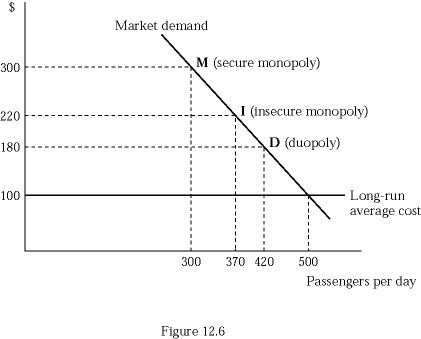

In Figure 12.6, airline Fly Smart is initially a secure monopoly between two cities X and Y at point M, serving 300 passengers per day at the profit maximizing price of $300 per ticket. Suppose that Fly Smart discovers that a second airline is contemplating entering the market. If the minimum market entry quantity is 130 passengers per day, what is Fly Smart's profit when it commits to the entry-deterring quantity?

In Figure 12.6, airline Fly Smart is initially a secure monopoly between two cities X and Y at point M, serving 300 passengers per day at the profit maximizing price of $300 per ticket. Suppose that Fly Smart discovers that a second airline is contemplating entering the market. If the minimum market entry quantity is 130 passengers per day, what is Fly Smart's profit when it commits to the entry-deterring quantity?

A. $60,000 B. $44,400 C. $33,600 D. $29,600

Consider an unregulated monopoly in Figure 13.2. Suppose that a second firm enters the market. As a result, the demand curve facing each firm lies entirely below the long-run average cost curve. Because having two firms in the industry makes both firms unprofitable, then the industry is classified as:

Consider an unregulated monopoly in Figure 13.2. Suppose that a second firm enters the market. As a result, the demand curve facing each firm lies entirely below the long-run average cost curve. Because having two firms in the industry makes both firms unprofitable, then the industry is classified as:

A. a natural monopoly. B. a duopoly. C. a monopolistic competitor. D. a pure competitor.