Solve the problem.A taxpayer's property has a fair market value of $110,000. The rate of assessment in the area is 50%. The tax rate is $3.35 per $100 of assessed valuation. Find the property tax.

A. $184,250.00

B. $3,685.00

C. $368,500.00

D. $1,842.50

Answer: D

You might also like to view...

Convert the angle in degrees to radians. Express the answer as multiple of ?.90°

A.

B.

C.

D.

Translate to a proportion and solve. 76 % of what is 138?

% of what is 138?

A. 18 B. 105.8 C. 180 D. 1800

An elderly rancher died and left her estate to her three children. She bequeathed her 17 prize horses in the following manner: 1/2 to the eldest, 1/3 to the second child, and 1/9 to the youngest.

?

The children decided to call in a very wise judge to help in the distribution of the rancher's estate. They informed the judge that the 17 horses were not of equal value. The children agreed on a ranking of the 17 horses (#1 being the best and #17 being a real dog of a horse). They asked the judge to divide the estate fairly so that each child would receive not only the correct number of horses but horses whose average rank would also be the same. For example, if a child received horses 1 and 17, the number of horses is two and the average value is

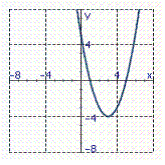

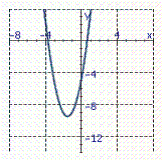

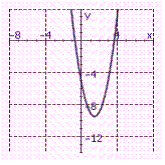

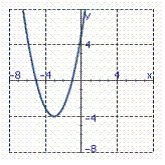

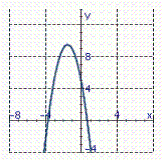

Identify the graph of the function.f ( x ) = x2 + 6x + 5

A.

B.

C.

D.

E.