In the United States, the federal income tax is an example of a

A) progressive tax. B) regressive tax. C) flat tax. D) proportional tax.

A

You might also like to view...

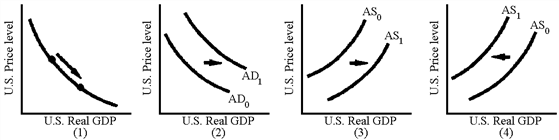

Figure 36-5

?

A. 1 B. 2 C. 3 D. 4

Assume that the reserve—deposit ratio is 0.2. The Federal Reserve carries out open-market operations, purchasing $1,000,000 worth of bonds from banks. This action increased the money supply by $2,600,000. What is the currency—deposit ratio?

A) 0.2 B) 0.3 C) 0.4 D) 0.5

The branch of mathematics that analyzes situations in which players must make decisions and then receive payoffs based on their own and others' decisions is called game theory

a. True b. False Indicate whether the statement is true or false

Using the income approach, net interest is included because

A. households both receive and pay interest. B. households pay but do not receive interest and firms receive but do not pay interest. C. firms pay but do not receive interest and households receive but do not pay interest. D. it is income to the government but not to households nor firms.