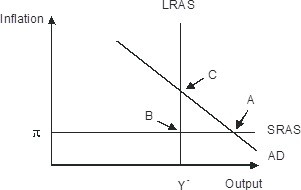

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A

B. recessionary; C

C. recessionary; B

D. expansionary; A

Answer: D

You might also like to view...

Taco Bell's economists determine that the price elasticity of demand for their tacos is 2.0. So, if Taco Bell raises the price of its tacos by 6.0 percent, the quantity demanded will decrease by ________ percent

A) 2.0 B) 3.0 C) 6.0 D) 12.0

What assumptions are necessary for a market to be perfectly competitive? Explain why each of these assumptions is important

What will be an ideal response?

If there is a positive demand shock, which of the following would represent the most likely short and long-run outcomes? (Assume the economy was initially at full employment)

a. In the short run, real GDP and the price level would increase; in the long run, real GDP would return to its original level while the price level would rise even further. b. In the short run, real GDP and the price level would increase; in the long run, real GDP and the price level would return to their original level. c. In the short run, real GDP would increase and the price level would decrease; in the long run, real GDP would return to its original level while the price level would rise even further. d. In the short run, real GDP and the price level would decrease; in the long run, real GDP would return to its original level while the price level would rise even further. e. In the short run, real GDP and the price level would increase; in the long run, real GDP would increase while the price level would return to its original level.

A firm has three different investment options. Option A will give the firm $10 million at the end of one year, $10 million at the end of two years, and $10 million at the end of three years. Option B will give the firm $15 million at the end of one year, $10 million at the end of two years, and $5 million at the end of three years. Option C will give the firm $30 million at the end of one year,

and nothing thereafter. Which of these options has the highest present value? a. Option A b. Option B c. Option C d. The answer depends on the rate of interest, which is not specified here.