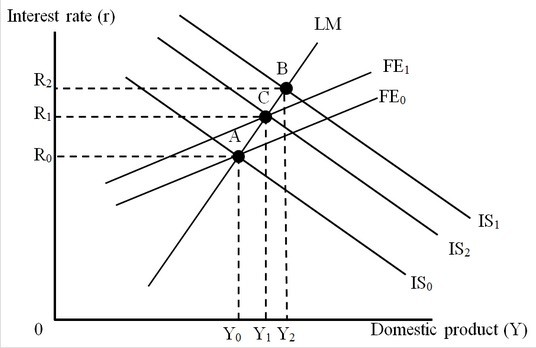

The figure below depicts the IS-LM-FE model with floating exchange rates. The move from Point A to Point B is caused by

The move from Point A to Point B is caused by

A. contractionary fiscal policy.

B. expansionary monetary policy.

C. expansionary fiscal policy.

D. contractionary monetary policy.

Answer: C

You might also like to view...

According to your textbook authors, the belief that economizing implies greedy behavior is

A) common but mistaken. B) uncommon but true. C) both common and true. D) neither common nor true.

You are expecting to receive $3,500 at some time in the future. Which of the following would unambiguously increase the present value of this future payment?

a. Interest rates rise and you get the payment sooner. b. Interest rates rise and you have to wait longer for the payment. c. Interest rates fall and you get the payment sooner. d. Interest rates fall and you have to wait longer to get the payment.

Since 1994 the number of people on the welfare rolls has

A. risen substantially. B. risen slightly. C. stayed about the same. D. fallen substantially.

A good time for an American to hold German stocks, ceteris paribus, is when the

A. The return in the German stock market has no relationship to the value of the dollar compared to the euro. B. U.S. dollar depreciates in value compared to the euro. C. Euro is stable compared to the U.S. dollar. D. U.S. dollar appreciates in value compared to the euro.