Why do corporate boards of directors sometimes link top managers' compensation to the corporations' stock prices? How might tying compensation too closely to stock prices create an incentive for corporate fraud

What will be an ideal response?

Corporate boards of directors sometimes link top managers' compensation to the corporations' stock price to lessen the principal-agent problem caused by the separation of ownership from control. Linking compensation to stock prices provides managers with an additional incentive to maximize shareholder profits. But tying compensation too closely to stock prices can cause management to maximize short-run profits over long-run profits and to commit corporate fraud to make the firm appear to be more profitable than it is with the intention of increasing the firm's stock price.

You might also like to view...

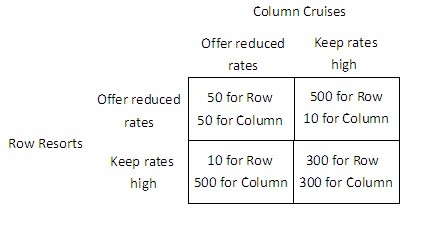

Refer to the figure below.  If Row Resorts keeps its rates high, then Column Cruises would receive the highest payoff if it:

If Row Resorts keeps its rates high, then Column Cruises would receive the highest payoff if it:

A. offered reduced rates. B. kept its rates high. C. chose either strategy because it will have the same payoff in either case. D. agreed with Row Resorts to reduce their rates at exactly the same time.

Refer to Figure 13-1. Ceteris paribus, a decrease in households' expectations of their future income would be represented by a movement from

A) AD1 to AD2. B) AD2 to AD1. C) point A to point B. D) point B to point A.

The subprime mortgage bubble featured ____ leverage and the technology stock bubble featured ____ leverage

a. significant; significant b. significant; limited c. limited; significant d. limited; limited

If the reserve ratio is 12.5 percent, then $2,000 of additional reserves can create up to

a. $8,000 of new money. b. $16,000 of new money. c. $32,000 of new money. d. None of the above is correct.