Suppose an identical tax is levied on capital, labor, and land. Would the tax have the same effect in each of these markets? Explain your answer

What will be an ideal response?

The effect of the tax would depend on the relative elasticities of supply and demand for land, labor, and capital. A tax on land falls mostly on landowners because the supply of land is very inelastic (land does not have an alternative use). Since capital the supply of capital is very elastic, a tax on capital falls largely on demanders. The effect of a tax on labor will depend on whether the supply or demand for labor is more elastic. If the demand for labor is inelastic, firms will bear a higher proportion of the tax. On the other hand, if the supply of labor is inelastic, workers will bear a higher proportion of the tax. The available empirical evidence suggests that the supply of labor is less elastic than demand. As a consequence, economists believe that workers bear most of the burden of a tax on labor.

You might also like to view...

Although it is possible to determine the present value of a payment to be received in one year, it is not possible to determine the present value of a stream of payments over several years

a. True b. False Indicate whether the statement is true or false

For this question, assume productivity has been increasing by 5% per year. Also assume that workers' expectations of productivity growth adjust slowly over time. For this economy, a reduction in productivity growth from 5% to 2% will most likely cause which of the following to occur?

A) an increase in the natural rate of unemployment B) a reduction in the real wage C) an increase in the markup over labor costs D) all of the above E) none of the above

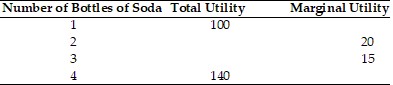

Using the above table, what is the total utility of consuming 2 bottles of soda?

Using the above table, what is the total utility of consuming 2 bottles of soda?

A. 140 B. 120 C. 240 D. 115

How will the development of the hybrid automobile, a car powered by both a gasoline engine and a battery, affect the market for gasoline?

A. Demand will increase B. Demand will decrease C. Supply will increase D. Supply will decrease