An oil-drilling company knows that it costs $95,000 to sink a test well. If oil is hit, the income for the drilling company will be $875,000. If only natural gas is hit, the income will be $340,648. If nothing is hit, there will be no income. If the probability of hitting oil is  and if the probability of hitting gas is

and if the probability of hitting gas is

style="vertical-align: middle;" data-wiris-created="true" varid="variable_id_field" variablename="impvar_eb48c6e9d46642ba81a356a23" />, what is the expectation for the drilling company? Should the company sink the test well? Please round your answer to the nearest dollar.

?

The expectation is __________, the company __________ (should, shouldn't) dig.

What will be an ideal response?

-$59,499; shouldn't

Mathematics

You might also like to view...

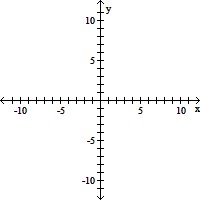

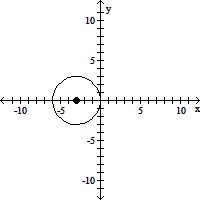

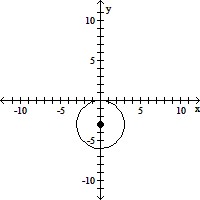

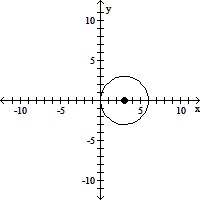

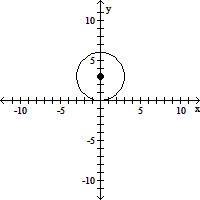

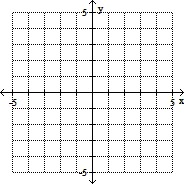

Graph the equation.x2 + (y - 3)2 = 9

A.

B.

C.

D.

Mathematics

Find the product.4t4(t - 5)(4t - 3)

A. 16t6 - 92t5 + 60t4 B. 16t6 - 80t5 + 60t4 C. 16t6 + 60t4 D. 16t6 + 60t5 - 92t4

Mathematics

Solve the inequality. > 0

> 0

A.

B.

C.

D. (0, ?)

Mathematics

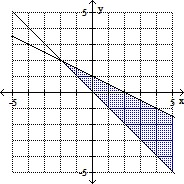

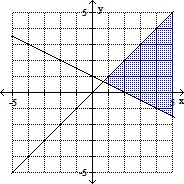

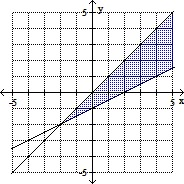

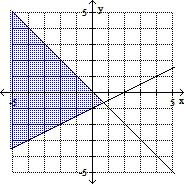

Graph the solution of the system.x + 2y ? 2 x + y ? 0

A.

B.

C.

D.

Mathematics