One area of disagreement among economists is the impact that income tax cuts will have on a budget deficit. Explain in detail the reasoning of both sides of this argument

A budget deficit occurs when government spending exceeds tax revenues. Some economists argue that income tax cuts will lead to a smaller deficit. Their reasoning is that if income taxes are cut, individuals will choose to work more and produce more. As a result, the tax base will rise because people are earning more income. As long as the percentage increase in the tax base is greater than the percentage decrease in the tax rate, tax revenues will rise. This will result in a smaller budget deficit. Those who disagree with this logic find it unlikely that the tax base will rise sufficiently enough to raise tax revenues, and thus they believe that a tax cut will make the budget deficit grow.

You might also like to view...

If a union successfully negotiates for higher wages and benefits for steel workers, what impact would this have on supply and demand in the market for steel, assuming no other changes take place in this market?

What will be an ideal response?

If real GDP in 2002 is $10 trillion, and in 2003 real GDP is $9.5 trillion, then real GDP growth from 2002 to 2003 is

A) 0.5%. B) 5%. C) 0%. D) -5%.

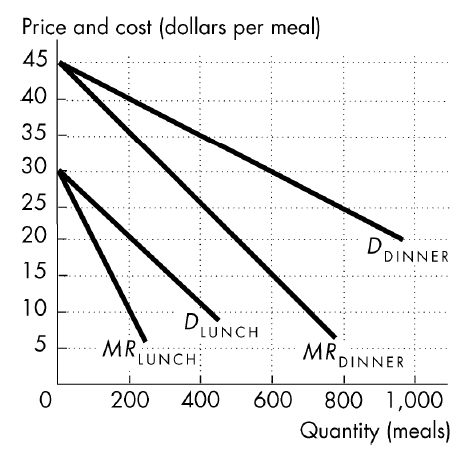

The figure below shows the demand for meals at lunch and dinner for a proposed new restaurant. Suppose the marginal cost of a meal (both lunch and dinner) is constant at $10 per meal and marginal cost of providing the capacity is constant at $5 per meal. Once the managers have determined the profit-maximizing capacity, at lunch they will serve ________ meals and set a price of ________ per meal.

A) 800; $30 B) 200; $20 C) 200; $30 D) 600; $30

What is the difference between a tariff and a quota?