Social insurance can be justified on the grounds of

A. adverse selection.

B. decision-making costs.

C. income distribution.

D. paternalism.

E. all of these answer options are correct.

E. all of these answer options are correct.

You might also like to view...

The United States is considered by the Institute for Management Development to be the most competitive economy because

A) U.S. residents are willing to work harder than anyone else is. B) of widespread entrepreneurship. C) of a high saving rate. D) of selected restrictions on imports from Japan and Europe.

The presence of large sunk costs often serves as a naturally imposed barrier to entry

a. True b. False Indicate whether the statement is true or false

Which of the following statements is most consistent with the benefits-received principle of taxation?

A. People with high incomes should pay more taxes than people with low incomes. B. A childless couple should not be required to pay taxes for the support of public schools. C. Prosperous corporations should pay substantial taxes even if they use few government goods and services. D. The best tax is the income tax.

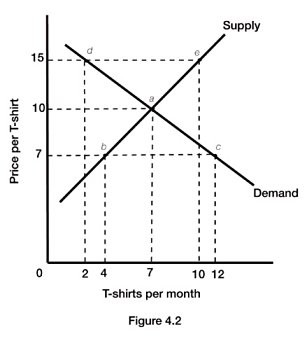

Figure 4.2 illustrates the supply and demand for t-shirts. If the actual price of t-shirts is $15, we would expect that:

Figure 4.2 illustrates the supply and demand for t-shirts. If the actual price of t-shirts is $15, we would expect that:

A. demand will decrease until quantity demanded equals quantity supplied. B. supply will increase until quantity demanded equals quantity supplied. C. price will decrease until quantity demanded equals quantity supplied. D. there will be no change in the price since the market is in equilibrium.