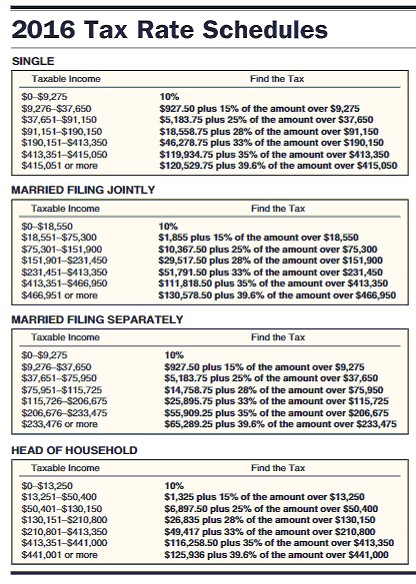

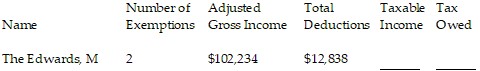

Find the amount of taxable income and the tax owed for the following people. The letter following the name indicates the marital status and all married people are filing jointly. Use $4050 for each personal exemption; $6300 as the standard deduction for single taxpayers, $12,600 for married taxpayers filing jointly, and $9300 for head of household and the following tax rate schedule.

A. $83,234; $13,485.52

B. $81,296; $11,866.50

C. $82,534; $9,849.00

D. $81,296; $13,138.88

Answer: B

You might also like to view...

Solve the problem.The resistance, in ohms, of a 25 foot piece of wire is given by the function  , where d is the diameter of the wire in inches. What happens to the resistance of the wire as the diameter of the wire decreases?

, where d is the diameter of the wire in inches. What happens to the resistance of the wire as the diameter of the wire decreases?

A. The resistance decreases. B. The resistance remains constant. C. The resistance increases. D. The answer cannot be determined without additional information.

Find the product.-12

A.

B. -

C. -

D.

Find the first term a1 and the common difference d of the arithmetic sequence.an = 3n + 8

A. a1 = 14, d = 11 B. a1 = 11, d = 8 C. a1 = 11, d = 3 D. a1 = 8, d = 14

Factor.256x4 - 36

A. (32x2 - 12)(8x2 + 3) B. 4(8x2 - 3)2 C. 4(64x4 - 9) D. 4(8x2 - 3)(8x2 + 3)