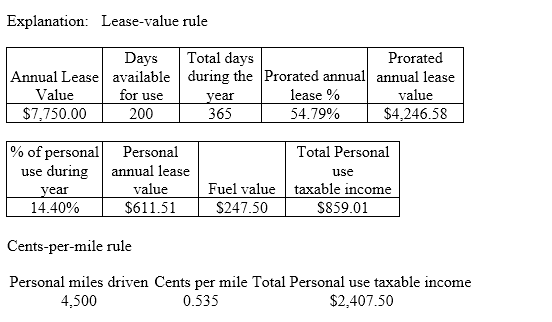

Lakiesha is an employee who drives a 2017 Buick Verano as a company car. The fair-market value of the car is $28,545. She has been given the choice to have her fringe benefit reported on her W-2 either using the lease-value rule or the cents-per mile rule. According to Publication 15-b, the lease value is $7,750. She has driven 4,500 miles for personal use and 31,250 miles in total during the

year. The car has been available for use on 200 days during the year. Lakiesha's employer pays for all fuel. What method and valuation will yield the lowest fringe-benefit amount for Lakiesha? (Do not round intermediate calculations, only round final answer to two decimal points.)

A) Lease-value, $859.01

B) Cents-per-mile, $859.01

C) Lease value, $2,407.50

D) Cents-per-mile, $2,407.50

A) Lease-value, $859.01

You might also like to view...

Name the stage of moral decision-making and action:

(1) Executing the plan of action ______. (2) The first stage or step of moral action ______. (3) Greatly influenced by rewards and emotional states ______. (4) Choosing between possible courses of action ______.

Andy Benton works at the local Starbucks coffee shop and his responsibilities include taking orders, fulfilling orders, and ringing in sales. At what level of the organizational pyramid would you categorize Andy?

A. Operational B. Owner C. Strategic D. Managerial

Focus forecasting tries a variety of computer models and selects the best one for a particular application

Indicate whether the statement is true or false

The description of the relation between a company's assets, liabilities, and equity, which is expressed as Assets = Liabilities + Equity, is known as the:

A. Income statement equation. B. Accounting equation. C. Return on equity ratio. D. Business equation. E. Net income.