Suppose you rent an apartment and are worried about a break-in that results in theft of your property. Suppose your monthly consumption level is currently $4,000 but a break-in would result in you having to finance your purchase of replacement property -- and this would reduce your current consumption to $2,000 per month. There is a 10% chance of a break-in.

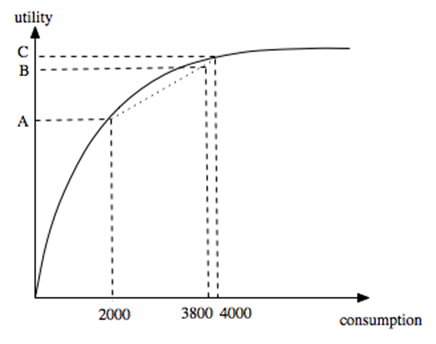

a. On a graph with "consumption" on the horizontal and "utility" on the vertical axis, illustrate a utility/consumption relationship that is consistent with risk averse tastes.

b. On your graph, illustrate the utility in the "good" state, the utility in the "bad" state and the expected utility of facing the gamble.

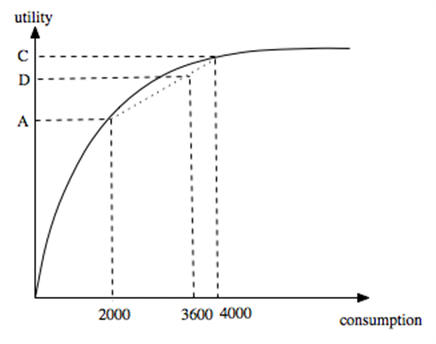

c. Which of these changes when the probability of a break-in increases to 20%?

d. A renter's insurance policy consists of a premium p and a benefit level b. What is (b,p) for full, actuarily fair insurance before and after the increase in risk?

e. True or False: You are more likely to buy actuarily fair full insurance after the increase in risk than before.

What will be an ideal response?

b. The utility of the "bad" state is given by A; the utility of the "good" state is given by C; and the expected utility is given by B.

c. The expected utility changes and becomes D in the graph below.

d. Before: (b,p)=($2,000; $200)

After:(b,p)=($2,000; $400)

e. False. In both cases, this individual will fully insure.

You might also like to view...

Which of the following would be considered unemployed as part of normal labor market turnover?

i. Juliet, who was fired when the company where she worked went bankrupt in a recession ii. Hannah, who quit her job to find one that better suited her skills iii. Charlotte, who started looking for a job upon graduation from high school A) ii and iii B) i and ii C) i, ii and iii D) i and iii E) iii only

In 2003, federal government expenditures as a percentage of GDP were around _____

a. 10 percent b. 20 percent c. 30 percent d. 40 percent

When a highly valued resource cannot be easily traded, as is often true with water flowing in a river, then

a. it will not be hoarded by the rich, but will be available to all on an equal basis. b. we can expect shortages from time to time, and conflicts over access to its use. c. its price will be low as a result. d. markets in the resource will clear more easily, without greed and profit to get in the way.

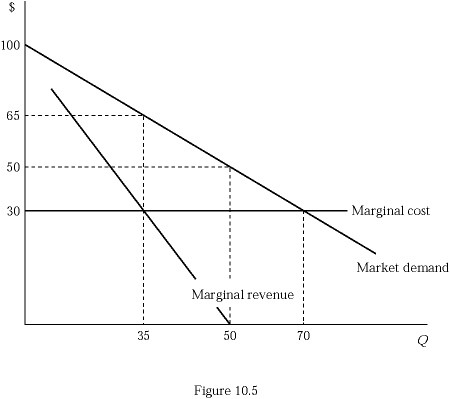

Refer to Figure 10.5. The deadweight loss associated with the monopoly would be:

Refer to Figure 10.5. The deadweight loss associated with the monopoly would be:

A. $787.5. B. $612.5. C. $262.5. D. There is not sufficient information.