The efficient market hypothesis states that:

A. markets currently contain an efficient amount of information for them to clear.

B. markets currently contain all available information and correctly value instruments.

C. when buyers and sellers act in their own best interest markets will be efficient.

D. in order for markets to be efficient they need to be adequately regulated.

Answer: B

You might also like to view...

In the above figure, if the interest rate is 4 percent, people

A) sell bonds so as to convert them into money. B) buy bonds so as to have a better store of value. C) petition the Fed to tighten the quantity of money. D) buy stocks, because stocks are more liquid than currency.

Policy is conducted via a rule if policymakers

a. use monetary and fiscal policy only when the political situation dictates it. b. set monetary and fiscal policy according to multiple but predetermined goals. c. a free to respond to unexpected changes in economic conditions. d. announce in advance how they will respond to changes in economic conditions.

If you lost 10 percent on $200 worth of stock in a 3x margin account, then you would lose:

A. $60. B. $20. C. $30. D. $40.

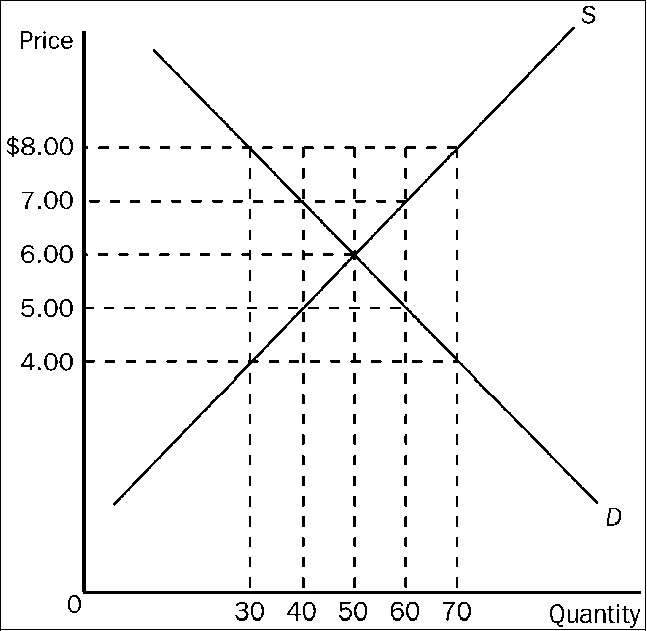

Figure 4-17

Refer to . If the government imposes a price ceiling in this market at a price of $5.00, the result would be a

a.

shortage of 20 units.

b.

shortage of 10 units.

c.

surplus of 20 units.

d.

surplus of 10 units.