Assume that you know the following cost information about Fred's widget company: Its fixed cost is $9, and its total variable cost is $6 for 1 unit; $11 for 2; $ 15 for 3; 20 for 4; and 26 for 5 . Given the above information,

a. the marginal cost of providing the second unit is $5.

b. the total cost of producing 4 units is $29

c. the average total cost of producing five units is $7.

d. all of the above are true.

d

You might also like to view...

Consider a market that is in equilibrium. If it experiences both a decrease in demand and a decrease in supply, what can be said of the new equilibrium? The equilibrium:

A. price and quantity will both fall. B. quantity will definitely fall, while the equilibrium price cannot be predicted. C. price will definitely fall, while the equilibrium quantity cannot be predicted. D. price and quantity will both rise.

In 2017, an income of $125,000 would, roughly, make a family

A. richer than 40 percent of U.S. households but poorer than 35 percent. B. richer than 50 percent of U.S. households but poorer than 25 percent. C. richer than 85 percent of U.S. households but poorer than 8 percent. D. richer than 95 percent of U.S. households but poorer than 1 percent.

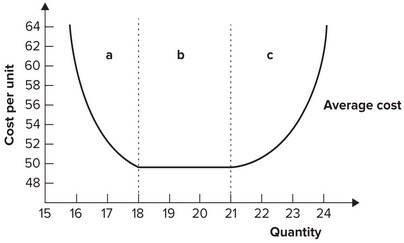

Refer to the graph shown. Given the long-run average cost curve, a seller must produce 18 units just to break even if the price the seller expects is roughly:

A. $52. B. $54. C. $50. D. $58.

The following question relates to an oligopoly market where the industry demand curve is P = 100 - Q. What will industry output be at equilibrium in this model?

What will be an ideal response?