The following question relates to an oligopoly market where the industry demand curve is P = 100 - Q. If the Bertrand model is assumed to be the appropriate one for analysis, what will be the price of the product and the quantity sold in this duopoly market?

What will be an ideal response?

Since both firms will undercut each other's price until they reach marginal cost, the price will end up at zero and the quantity will be 100, which is all that can be given away at zero price.

You might also like to view...

Which of the following is a variable cost for an airline?

a. insurance b. property taxes c. jet fuel d. rent of airport space

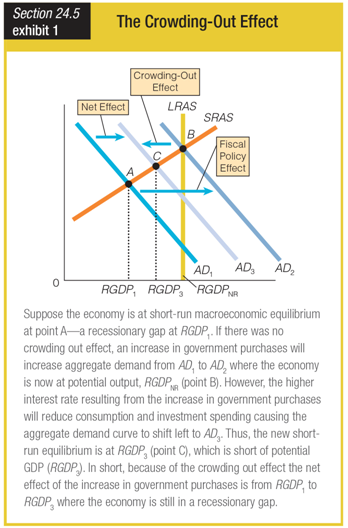

Based on the graph showing the crowding-out effect, the crowding-out effect ______ aggregate demand.

a. increases

b. decreases

c. eliminates

d. has no effect on

The real exchange rate is the:

A. price of the average domestic good or service relative to the price of the average foreign good or service, when prices are expressed in terms of a common currency. B. quantity of foreign currency assets held by a government for the purpose of purchasing the domestic currency in the foreign exchange market. C. nominal exchange rate adjusted for domestic inflation. D. rate at which two currencies can be traded for each other.

The money multiplier is calculated as (1 ÷ required reserve ratio).

Answer the following statement true (T) or false (F)