A family that earns $20,000 a year pays $200 a year in city wage taxes. A family that earns $40,000 a year pays $1,600 a year in city wage taxes. The city wage tax is

A. a progressive tax.

B. a regressive tax.

C. a proportional tax.

D. a benefits-received tax.

Answer: A

You might also like to view...

When a Clarke tax is used to finance a public good, each person's tax equals

a. the amount that he is willing to pay for the good. b. the difference between the value he places on the public good and its cost. c. the cost of the public good minus the value that other people claim to receive from it. d. everyone else's tax, with the sum equaling the cost of producing the public good.

Is fiscal policy more or less effective in manipulating aggregate demand in an open economy?

What will be an ideal response?

What is the term used for the process by which an entrepreneur creates or recognizes a new and better product, acquires it, and brings it to market, making older substitutes obsolete?

A. Creative destruction B. Innovation C. The substitution effect D. Backward-bending innovation

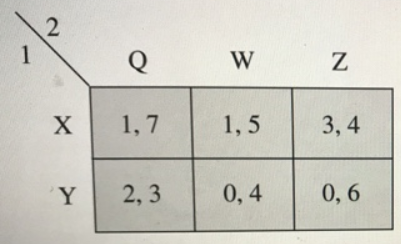

Consider the game above. at the mixed strategy equilibrium, the probability that player 2 assigns on Z =