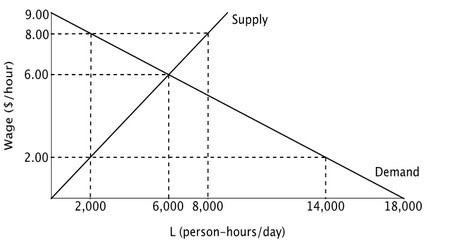

Consider the accompanying figure representing the labor market below. Suppose the government passes a minimum wage requiring employers to pay at least $8.00 per hour. Prior to the imposition of the minimum wage, employer surplus is ________ per day, and after the imposition of the minimum wage, employer surplus is ________ per day.

Prior to the imposition of the minimum wage, employer surplus is ________ per day, and after the imposition of the minimum wage, employer surplus is ________ per day.

A. $18,000; $2,000

B. $18,000; $14,000

C. $9,000; $5,000

D. $9,000; $1,000

Answer: D

You might also like to view...

A learning curve may be stated as L = A + BN-b where L is the labor per unit and N is the cumulative number of units produced. Learning does not occur when

A) b = 0 B) b = 1 C) b > 0 D) b < 0

Monetary neutrality implies that an increase in the quantity of money will

a. increase employment. b. increase the price level. c. increase the incentive to save. d. increase the real interest rate.

Joe is the owner of the 7-11 Mini Mart, Sam is the owner of the SuperAmerica Mini Mart, and together they are the only two gas stations in town. Currently, they both charge $3 per gallon, and each earns a profit of $1,000. If Joe cuts his price to $2.90 and Sam continues to charge $3, then Joe's profit will be $1,350, and Sam's profit will be $500. Similarly, if Sam cuts his price to $2.90 and Joe continues to charge $3, then Sam's profit will be $1,350, and Joe's profit will be $500. If Sam and Joe both cut their price to $2.90, then they will each earn a profit of $900.For Joe, keeping his price at $3 per gallon is a:

A. profit-maximizing strategy. B. dominant strategy. C. revenue-maximizing strategy. D. dominated strategy.

Having a nominal inflation target for monetary growth can pose a difficulty because:

A) inflation is very challenging to measure. B) inflation can be higher or lower, depending on the growth rate of real GDP. C) most agree that inflation targets are completely unrelated to monetary growth. D) monetary growth can be affected by political pressure and other noneconomic factors.