Explain the difference between the unrelated diversification strategy and the two related-diversification strategies in terms of how they create the economies that make them successful.

What will be an ideal response?

The related-diversification strategies rely on economies of scope which they generate through either operational relatedness or corporate relatedness. A few firms simultaneously seek both operational and corporate relatedness, although this is very difficult and few firms achieve it. Both operational and corporate relatedness are based on sharing either of resources or of core competencies. Unrelated diversification strategies seek financial economies, and the divisions in these types of firms operate separately competing for capital in the organization's internal capital market.

You might also like to view...

Find the derivative of y with respect to the independent variable.y =log8

A.

B.  (sec ? csc ? - ln 5 -1)

(sec ? csc ? - ln 5 -1)

C.  (cot ? - tan ? - ln 5 -1)

(cot ? - tan ? - ln 5 -1)

D. e8(cos ? - sin ? - e?5?)

Evaluate.log100.1

A. -1 B. 0 C. 3 D. -3

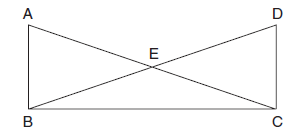

If AB ? BC, DC ? BC, and AB ? CD in the figure, prove that ?BAC ? ?CBD.

Perform the indicated operation and express in lowest terms.  +

+

A.

B.

C.

D.