If the nominal interest rate is 10 percent, the inflation rate is 6 percent, and the tax rate on interest income is 25 percent, what is the after-tax real interest rate?

A) 1.5 percent B) 4.0 percent C) 3.0 percent D) 6.0 percent E) 3.5 percent

A

You might also like to view...

Assume the economy is operating at a real GDP above full-employment real GDP. Keynesian economists would prescribe which of the following policies?

a. Nonintervention b. Fixed rule c. Contractionary d. Expansionary

In a perfectly competitive market, the price is currently above the minimum of each firm's long-run average total cost curve. Which of the following statements is correct?

a. The long-run average total cost curve will shift upward in the long run. b. Firms will alter their plant size in the short run. c. The market price will fall in the long run. d. The firms must be producing at an output level where price exceeds short-run marginal cost. e. The firms will earn above-normal profit in the long run.

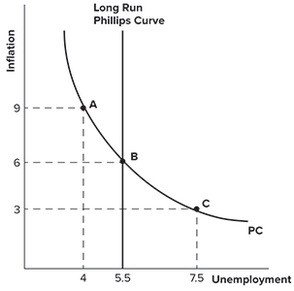

Refer to the graph shown. Suppose an economy begins at point B but then adopts an expansionary monetary policy. In the short run, this policy would most likely:

A. raise inflation to 9 percent and raise unemployment to 7.5 percent. B. raise inflation to 9 percent and reduce unemployment to 4 percent. C. reduce inflation to 3 percent and reduce unemployment to 4 percent. D. reduce inflation to 3 percent and raise unemployment to 7.5 percent.

A potential benefit that comes from social regulations would be

A. higher tax collections. B. more layoffs. C. higher costs. D. a cleaner environment.