What factors determine the size of the price elasticity of demand?

What will be an ideal response?

The factors that determine the size of the elasticity of demand can be classified into the availability of substitutes for the good and the proportion of income spent on the good. The more substitutes for a good, the more elastic its demand. Luxuries have more substitutes than necessities, and so the elasticity of demand for luxuries exceeds that for necessities; narrowly defined goods have more substitutes than broadly defined goods, and so the elasticity of demand for narrowly defined goods exceeds that for broadly defined goods; and, the more time that has elapsed since a price change, the more substitutes consumers can find, and so the elasticity of demand is larger the more time passes. Income also plays a role because the larger the proportion of consumers' incomes spent on a good, the larger is its elasticity of demand.

You might also like to view...

If autonomous investment increases by $200 billion and the marginal propensity to consume (MPC) is 0.5, then

A) real Gross Domestic Product (GDP) will rise by $100 billion. B) real Gross Domestic Product (GDP) will rise by $200 billion. C) real Gross Domestic Product (GDP) will rise by $400 billion. D) real Gross Domestic Product (GDP) will decrease by $100 billion.

When comparing perfect competition and monopolistic competition, we find that

A) firms in monopolistic competition produce identical products just as do firms in perfect competition. B) firms in monopolistic competition face barriers to entry, unlike firms in perfect competition. C) advertising plays a large role in monopolistic competition, unlike in perfect competition. D) firms in monopolistic competition are price takers just as is the case for firms in perfect competition.

A bank's return on equity (ROE) is calculated by:

A. dividing the banks liabilities by the bank's capital. B. dividing the bank's net profit after taxes by the sum of the bank's assets and its liabilities. C. taking the bank's assets plus the net profit after taxes and dividing this sum by the bank's capital. D. dividing the bank's net profit after taxes by the bank's capital.

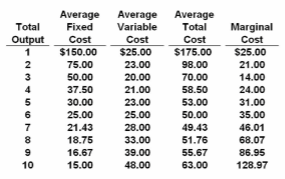

Refer to the data. We can infer that, at zero output, this firm's total fixed, total variable, and total costs are:

A. zero, zero, and zero, respectively.

B. zero, $25, and $175, respectively.

C. $150, $25, and $175, respectively.

D. $150, zero, and $150, respectively.