If a tax system has no deductions, exemptions, or other loopholes, then the effective tax rate will be

A. Equal to the nominal tax rate.

B. Greater than the nominal tax rate.

C. Less than the nominal tax rate.

D. Equal to the vertical tax rate.

Answer: A

You might also like to view...

The above table shows production points on Sweet-Tooth Land's production possibilities frontier. What is the opportunity cost of one can of cola if Sweet-tooth Land moves from point C to point B?

A) 20 chocolate bars per can of cola B) 10 chocolate bars per can of cola C) 2 chocolate bars per can of cola D) 1/2 chocolate bars per can of cola

If, for a $1000 premium, you buy a $100,000 put option on bond futures with a strike price of 110, and at the expiration date the price is 114, your ________ is ________

A) profit; $1000 B) loss; $1000 C) profit; $3000 D) loss; $3000

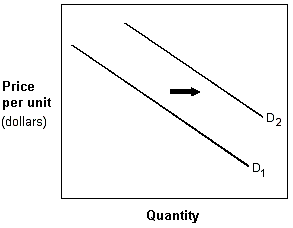

Exhibit 3-2 Demand curves

A. Decrease in price. B. Increase in expected future prices. C. Increase in the price of a complement. D. Decrease in income if it is a normal good.

In the mid-1970s, the United States switched from running a trade ________ to running a trade ________.

A. deficit; surplus B. surplus; deficit C. balance; surplus D. deficit; balance